Non-US Seller Real Estate Tax Withholding

FIPRTA

US law requires that the transferee (buyer) on a sale or disposition of a United States Real Property Interest withhold a percentage (typically 15%) of the total amount realized (the sales price) at the time of disposition (closing of sale). This is the law known as “FIRPTA”- the Foreign Investment in Real Property Tax Act. So when a foreign party sells US real estate, the buyer (via the escrow company or settlement agent in most states), must withhold a significant amount of the sales price, and (probably) send it into the IRS. The withholding tax is not an actual tax due. It is better thought of as a security deposit which the IRS requires the foreign seller to submit to ensure the foreign seller will pay the tax.

Who Counts as a Foreign Party?

Foreign parties, who are subject to withholding, include the following: a nonresident alien (a foreign individual); a foreign corporation; a foreign partnership; a foreign trust; and a foreign estate. Nonresident aliens are individuals who are neither US citizens nor legal full-time US residents (other than students…students are a special category where the foreign person can be a legal full-time US resident and still be considered foreign and subject to withholding when selling US real estate ).

Example (1). A US citizen living in Paris sells his Los Angeles vacation home- no withholding required on US citizens (no matter where they live at the time of sale).

Example (2). A Danish citizen has a H1B visa, lives and works in San Diego and sells her San Diego home- no withholding on legal full-time US residents.

Example (3). A Canadian vacationing 5 months a year in the US on a Canadian tourist visa sells her Palm Springs house- 15% withholding required, the Canadian citizen is on a vacation visa in the US and is not a legal US resident.

Example (4). A Canadian vacationing 5 months a year in the US on a Canadian tourist visa sells her Palm Springs house, also happens to have a social security number from she when worked in the US 5 years ago- 15% withholding required, the Canadian citizen is on a vacation visa in the US and is not a legal US resident, the fact that she has a social security number does not change the fundamental facts that she is not a US citizen nor a US resident at the time of sale.

What are the Actual Rates of Withholding ?

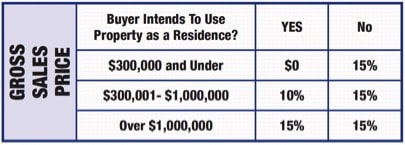

The IRS requires 15% of the sales price be withheld on the sale of United States real property interests by foreign persons (on sales above $1,000,000), and either 15% or 10% on sales between $300,001 and $1,000,0000, and either 15% or $0 for sales of $300,000 and under. The lower withholding amount at both levels requires the buyer to purchase the property with the intent to use it as a residence.

Note for sales of $300,000 or less, it is possible the foreign seller will not owe any withholding tax. That does not mean he or she won’t owe any income tax on the sale, it just means the IRS is willing to trust the foreign seller to send in the actual tax owed, and the IRS will not require the foreign seller to send in the refundable withholding tax at closing.

Example (4). In 2014, Chinese citizen/residents Cindy & Jimmy purchase a Los Angeles house for $1,000,000. In January 2017, they sell the house for $1,200,000. The withholding tax on the sale is $180,000 ($1.2M x 15 percent = $180,000). The real income tax owed on this sale is approximately $30,000, because in the US property sales are generally taxed at a rate of 15% x the appreciation on sale ($200,000 x 15% = $30,000). Despite only owing $30,000 in actual income tax, at the time of closing $180,000 is sent into the IRS by the escrow company. Cindy & Jimmy will be entitled to a $150,000 refund, but will likely wait well over a year for the refund, maybe more.

Example (5). In 2014, Chinese citizen/residents Cindy & Jimmy purchase a Los Angeles house for $1,500,000. In January 2017, they sell the house for $1,200,000. The withholding tax on the sale is $180,000 ($1.2M x 15 percent = $180,000). The real income tax owed on this sale is $0, because there is no appreciation on the sale. The $180,000 withholding tax is required even though there is no gain whatsoever on the sale. Cindy & Jimmy will likely wait well over a year for the refund, maybe more.